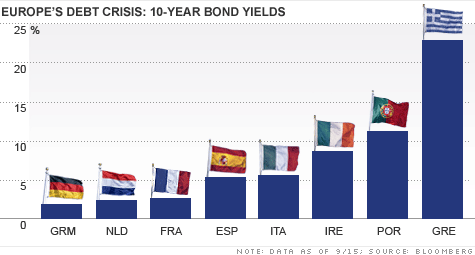

When a bank says you’re over indebted it probably means you have too much debt and either have to change your lifestyle dramatically, or file for bankruptcy. Lately there’s been a lot of news coverage about the European debt crisis. I’m going to try and explain what it is and how it will affect us. In some European countries like Germany people work hard, the economy grows, and the government lives within its means. But then other countries like Greece have tax evasion problems, citizens are opposed to austerity, and the government has to overspend to keep the population happy and the economy running. Chart below is from last year.

image source: money.cnn.com

It shows that anyone could have lent money to Greece in 2011 and get paid over 20% interest every year over the next 10 years. But when something looks too good to be true, it probably is. Because earlier this year, Greek defaulted and couldn’t pay their lenders the promised amount, and investors lost half of their initial investments. Greece basically went through a mild version of a bankruptcy. Today strong European countries are still financially supporting the weaker ones. Tax payer’s dollars, or rather Euros, from Germany are being lent to heavily indebted countries like Greece and Ireland. But voters in Germany are getting tired of doing this. It’s like equalization payments in Canada, except instead of a direct payment, these transfers are just “loans” for now which may, or may not be paid back later.

Unfortunately the solution isn’t as simple as kicking Greece out of the Eurozone altogether. If they completely default and leave, then their old debts will just move around to other countries and not really solve anything. It’s like if I borrow $100 from my friends and spend it all, then file for bankruptcy and don’t pay them back, then my balance will still be zero. But it’s my friends who actually lost $100 in the end. In Greece’s case they’ve already borrowed hundreds of billions of Euros from surrounding countries. Is it fair for German tax payers to foot the bill because leaders in Greece failed to properly run their own country? Leaving the Euro zone won’t be ideal for Greece either because without ongoing loans from Germany how would they continue to pay for government services like education? It would be a massive blow to their economy and standard of living if they leave.

Global financial markets are very interconnected, and investors are worried this European debt will spread around the world. If Greece goes bankrupt entirely then bond rates in Germany will rise, slowing down their growth. Companies in the US and China with exposure to Germany will also slow down. For normal citizens like us though, it probably means we’ll see stagnating wages and lower economic demand for the near term.

But not all is bad news >^_^< This is probably one of the best stock buying opportunities of the year. Look at names like Silver Wheaton, Magna International, and Suncor. They are trading so cheap. These are top quality companies that are growing their profits. The only reason their stock price is down is because of P/E compression, which is a market sentiment, not company specific. I’m going buy some of these names soon because when the economy gets back to normal these stocks will be the winners. I’m just waiting for the TSX to turn around right now, but so far it doesn’t look like we have hit a bottom yet.

The situation in Europe is a little scary. If other countries don’t keep propping up the other countries’ economies, it could be quite disastrous. Has this kind of thing always been going on in the economy? It seems that with all the bailouts that companies and governments are no longer responsible for their own mismanagement. As long as they are big enough, they can be reckless and someone will just give them a bunch of money to stay afloat. Where’s the incentive to actually run things properly?

You’ve nailed the real problem. People who run too-big-to-fail companies or countries lack accountability. Plus they are still padding their own pockets while asking for more bailouts lol.

I’m still too worried about Europe to make any major moves. I think Greece will have another “default” event, especially with the public pressures against austerity. I don’t see a way to unwind this without hurting someone.

That’s pretty much my sentiment too. Spain has something like 24% unemployment rate, very unsettling. Maybe I will start making smaller investments now and slowly dollar cost average down in the worst case scenario.